Why Self Storage?

Self-storage has been one of real estate’s top performing sectors since its inception in the 1960s, with high rates of appreciation and rent growth, low vacancy, and low default rates—even through recessions.

Nearly every market has a need for self-storage in good economic times as well as bad. In good times, people upsize their homes and buy more things and businesses expand. During downtimes, people downsize their homes and mid-size businesses consolidate inventory. During the heights of the Great Recession of 2008, Storage of America saw its revenue drop only 3% during a two-month period.

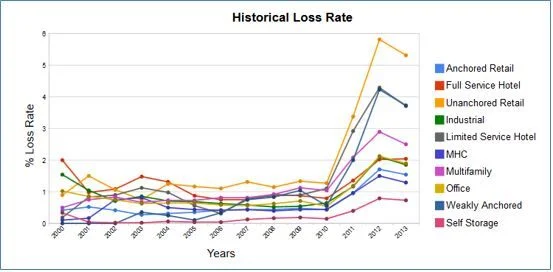

An analysis of CMBS loans across all real estate sectors from 2000 through 2013 showed that self-storage had the lowest default rate and lowest loss rate of any other real estate sector, with a default rate of less than 1%, compared to 4.5% average across all property types (CCIM).

Demographic trends suggest self-storage will be a mainstay for decades to come as Baby Boomers retire and downsize and as Millennials upsize. The rise of online businesses suggests that the share of businesses using self-storage to hold inventory will also continue to increase. Business users comprise of 20% of Storage of America’s customers across its entire portfolio.

Source: Inside Self Storage

Other benefits of self-storage include its straight-forward construction process and low maintenance requirements. When a tenant moves out of an apartment, for example, carpets need replacing, walls need repainting, appliances need repairing, etc. resulting in a costly and time-consuming turnaround. When a tenant moves out of a self-storage unit, the unit is swept out and can be rented to someone new that same day.

Despite month-to-month tenant contracts being the norm in the self-storage industry, the average Storage of America tenant rents for 17 months.

Compared to other real estate types, self-storage costs far less to build, is significantly cheaper to operate, has steadier occupancy, and produces a stronger net operating income (NOI). In most markets, self-storage attracts the same rental rate per square foot as apartments, but with a fraction of the construction costs and operating expenses.